Thai real estate as investment

You might not be buying your property purely for investment - but whether you are looking for a primary residence, for a luxury villa to make into a holiday home, a place for your kid to live while they are going to university, or a place to retire - investment appeal is always a part of consideration. Thailand’s real estate is and remains an attractive investment - however, you don’t have to take our word for it. Let’s go through the basics.

Price levels

Despite healthy price growth (see in the next section), Thailand still remains reasonably affordable. According to Global Property Guide data, Bangkok ranks 32nd in the global rank of most expensive prime cities, with an average price per sqm of $5,255 - against Hong Kong’s $28,570, London's $26,262 and New York’s $17,191 (prices of 120 sqm apartments are used as a basis for comparison).

| # | Country/City | Buying Price, USD/sqm |

|---|---|---|

| 1 | Hong Kong, Hong Kong Island | $ 28,570 |

| 2 | UK, London | $ 26,262 |

| 3 | US, New York | $ 17,191 |

| 4 | Israel, Tel Aviv | $ 17,149 |

| 5 | Switzerland, Geneva | $ 16,467 |

| 6 | Japan, Tokyo | $ 16,322 |

| 7 | France, Paris | $ 15,867 |

| 8 | Singapore | $ 14,373 |

| 9 | Austria, Vienna | $ 11,915 |

| 10 | China, Beijing | $ 11,829 |

| 11 | Canada, Toronto | $ 10,947 |

| 12 | India, Mumbai | $ 10,932 |

| 13 | Finland, Helsinki | $ 10,386 |

| 14 | Taiwan, Taipei | $ 10,373 |

| 15 | Norway, Oslo | $ 10,268 |

| 16 | Australia, Sydney | $ 8,783 |

| 17 | Sweden, Stockholm | $ 8,669 |

| 18 | Netherlands, Amsterdam | $ 8,558 |

| 19 | Czech Republic, Prague | $ 8,293 |

| 20 | Italy, Rome | $ 8,170 |

| 21 | Russia, Moscow | $ 7,818 |

| 22 | Germany, Berlin | $ 7,325 |

| 23 | Bermuda | $ 7,056 |

| 24 | BVI, Tortola | $ 6,469 |

| 25 | Spain, Madrid | $ 6,173 |

| 26 | UAE, Dubai | $ 5,918 |

| 27 | Luxembourg | $ 5,710 |

| 28 | Turkey, Istanbul | $ 5,680 |

| 29 | Malta, Valleta | $ 5,674 |

| 30 | Denmark, Copenhagen | $ 5,306 |

| 31 | New Zealand, Auckland | $ 5,272 |

| 32 | Thailand, Bangkok | $ 5,266 |

| 33 | Brazil, Sao Paolo | $ 4,833 |

| 34 | Portugal, Lisbon | $ 4,749 |

| 35 | Slovenia, Ljubljana | $ 4,535 |

| 36 | Greece, Athens | $ 4,488 |

| 37 | Barbados, St James | $ 4,467 |

| 38 | South Africa, Cape Town | $ 4,214 |

| 39 | Cayman Is., Grand Cayman | $ 4,163 |

| 40 | Estonia, Tallinn | $ 3,956 |

Thailand also hasn’t yet joined the house price boom overseas. With residential prices in the USA, UK and Australia growing at a record pace in 2021, Thailand offers a more affordable, more reasonable and - may we say - a more sustainable alternative.

The lower entry price also makes purchasing real estate here less disruptive for you, and on the other hand, allows you to create a diversified portfolio more easily if you want to go there.

(Besides, where else can you buy a gorgeous 3-bedroom island sea view villa for $500,000?)

Top Real Estate Property Investment in Thailand

Although the property market in Thailand is incredibly robust and healthy, there are no signs of it slowing in pace anytime soon. Whether you are looking at high-end condos in Bangkok or exclusive villas in Phuket, the potential to find some of Asia’s most enigmatic, affordable real estate investment properties has never been greater.

The Heart of Urban Living: Luxury Condos in Bangkok

If you’re in the market for high-end residential properties in Thailand, Bangkok has some of the most sensational real estate property to be found anywhere. Luxury condos in Bangkok are an exclusive part of a buoyant, robust market catering to those lucky enough to escape the world of rentals in Bangkok and acquire real estate in Thailand for themselves.

A Bangkok real estate property investment can be rewarding when choosing to live there or lucrative when using real estate property as an investment vehicle.

The Coastal Elegance of Luxury Villas in Phuket

When the subject turns to luxury houses and villas in Phuket, we picture stunning ocean vistas overlooking pristine white-sand beaches and crystal waters. Sensational fresh seafood, glorious sunshine, and incredible biodiversity are everywhere in this island paradise, and luxury villas for sale in Phuket have become a hot commodity as the world turns its attention to this incredible location.

Capital appreciation

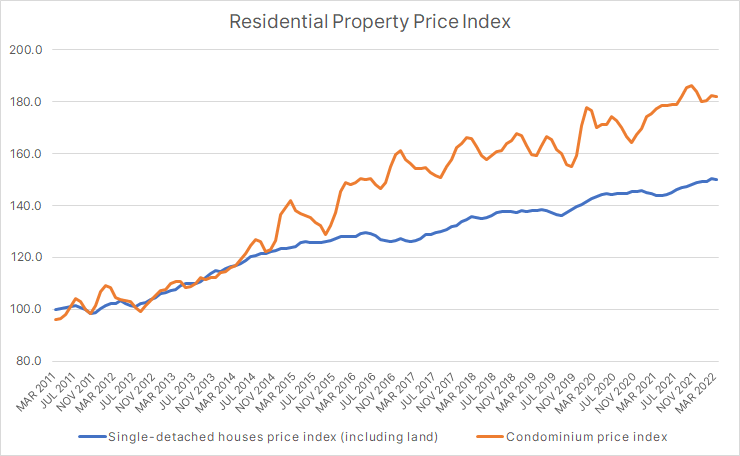

Thailand’s prices historically have been steadily growing with average appreciation over 2011-2021 of ~4% per annum for landed properties country-wide and ~6% for condos.

Despite the obvious slowdown in the property market during COVID, we expect the trend to continue with the reopening of the country and recovery of international travel.

Source: Bank of Thailand

While demand in the mid and low-range remains sluggish (as of March 2022), there is a strong recovery in certain sectors. Current appreciation is driven mainly by local demand for detached homes in major cities, as well as sustained demand for high-quality second homes and vacation homes in resort destinations. The worldwide trend towards bigger units and self-sufficient amenities is reflected in both demand and future supply pipelines.

👉 SUNWAY COMMENT

While developers in major resort destinations are largely close to being done going through pre-COVID unit inventory, it would be a generally be good advice - in terms of capital appreciation - to avoid areas with high amounts of oversupply, like certain parts of Pattaya. However, if you want to buy something affordable for self-use, high competition between sellers in those places can land you a really attractive price.

Infrastructure development

Thailand is in a unique position where it already has most of the necessary infrastructure to maintain high living standards, however still has a lot of potential for development. Consider the following: out of 14 (existing and upcoming) mass transit lines in Bangkok, 6 are either under construction or are preparing to start construction. Out of 8 operational ones, all are, one way or another, scheduled for future extension. Every new subway or light rail station will lead to new areas coming into prominence (and land growing in prices accordingly).

This is not an isolated case, the country has multiple large-scale infrastructure developments, and countless local ones. The current Thai government made infrastructure its priority number one; the private sector took note. Just a few examples.

A new airport serving Phuket will be built in Phang Nga next to Sarasin Bridge. A new marina project is coming up on Koh Samui. There are several high-speed train lines in planning, including Don Mueang–Suvarnabhumi–U-Tapao high-speed railway connecting the 3 airports, and another international route connecting Thailand to China via Laos.

Moreover, there are multiple large-scale industrial and commercial infrastructure development programs, including EEC (Eastern Economic Corridor) and a comprehensive Thailand 4.0 economy development policy. The government shows a clear commitment to investing in modern infrastructure, with a 1.4 trillion THB commitment in 2022 alone.

Currency

Due to its stability, many consider the Thai Baht a robust, ‘safe-haven’ currency among other emerging market currencies.

Historical data by XE

While THB remained strong during 2018/2019, it depreciated during the COVID pandemic, offering property buyers a more attractive exchange rate. Moreover, with international travel recovery and subsequent strengthening of THB you will be poised to make currency gains.

Ease of ownership

Thailand Condominium Act gives foreigners the right to entirely and directly own condominium units. There are certain restrictions: foreign buyers cannot own more than 49% of the total sellable area in any given project, and money for condo purchases by foreigners must come from abroad. Still, these are easy to comply with and are hardly prohibitive. Otherwise, you are free to sell your unit, rent it out, leave it to your kids as an inheritance etc.

While foreigners cannot directly own land, in practice, landed properties are often purchased under Thai company setup or as leasehold.

Rental yield

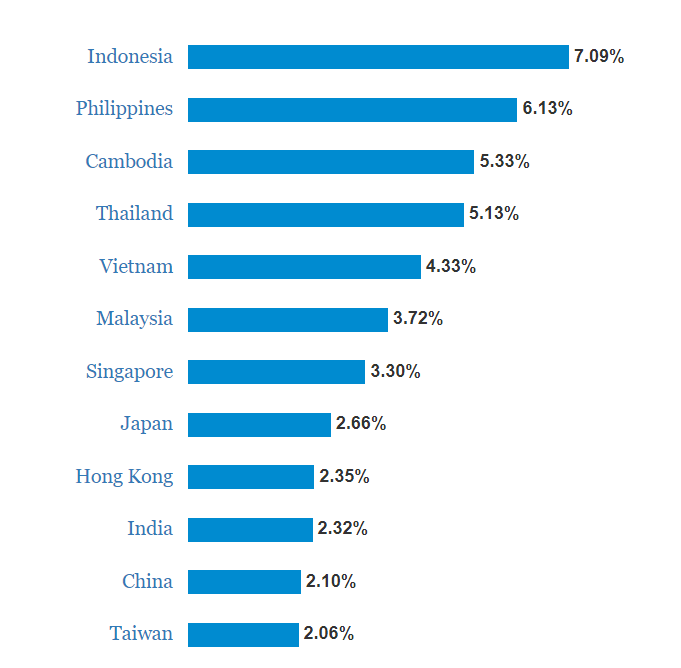

Thailand has consistently been one of top performers in Asia when it comes to rentals, only topped by Indonesia, Cambodia and Philippines.

Data by Global Property Guide

(Note that these numbers are based on city centre 120 sqm condos)

For the purposes of this article, Thailand’s rental market can be broadly divided into 2 segments: resort destinations and urban destinations. Urban destinations, for most foreign buyers, will basically mean just Bangkok.

We cover rental options in more detail in a dedicated article, but we’ll reiterate some of it here.

Resort destinations

These include Phuket, Samui, Pattaya, Hua Hin, Koh Chang and smaller coastal towns.

The rental income here will capitalise on short-term daily rentals to tourists or on a combination of long-term and daily rentals. Many local properties will have some sort of rental management program in place, often with hotel management/branding. Owners have the following options:

-

Rental guarantee - normally offered in the new projects for several years after handover.

- Rental pool - a program where the project units are managed in one or several rental pools, with rental income shared between the management company and the owners.

- Real estate management - traditional ad-hoc real estate rentals managed by the project management, 3rd party agency or owner themselves. The owner gets a return based on their unit’s actual rental gains, with a commission payable to the rental agency.

Usually, depending on a property type, you can count on a 5-8% net annual rental yield. More is possible with properties that are either exceptional or ideally suited for rentals (or bought well below the market).

One thing to keep in mind about resort cities is that the demand there is seasonal, with highly defined low and high seasons, generally tied to local climate (although to be fair, the difference in tourist flow during low and high seasons nowadays is not as dramatic as even 10 years ago).

Many buyers choose a mixed scenario, where they stay in their unit part of the year (this may be European winter or just an extended summer vacation) and rent it out the rest of the time. This limits the rental yield (not just because the unit can’t be rented out on the dates the owner uses it, it’s also more challenging to schedule bookings around those dates), especially if the stay corresponds with high or peak season.

Generally, buying in a resort city offers attractive returns, as well as a degree of flexibility and lifestyle appeal.

Urban destinations

Bangkok. We’re talking about Bangkok. Although Bangkok started seeing rental pool programs in the past several years (very few cases, mostly limited to a handful of mid-range hotel-branded residences), the rental market here remains very conventional.

A number of real estate agents can list your unit - as either an exclusive or non-exclusive agent - and rent it out, primarily for the long term - starting from 12, sometimes 6, months. Short-term rentals (like AirBnB rentals) are also common, but they are mostly done to supplement long-term rentals, used for apartments only available part of the year or done by owners.

You can expect 4-7% yields for Bangkok properties depending on property type.

The main advantage of Bangkok here is that it’s a mature market that doesn’t rely on tourism to the same extent as islands and offers more stability.

Property taxes

Thailand offers an attractive taxation system when it comes to real estate.

We have a dedicated article discussing this topic in more detail: Taxes and transfer fees, but here is the gist:

Taxes and fees on property purchase

Total taxes on the purchase of a new freehold condo amount to 6.3% of the contract price:

- Specific business tax - 3.3%

- Transfer fee - 2%

- Withholding tax - 1%

However, the developer usually pays most of it with the buyer paying only 1%.

In the case of resale, specific taxes can vary based on the property price and duration of ownership. It must be noted that in the case of resale, the appraised value is used for the calculation of transfer fees and withholding tax, which is normally lower than the transaction price.

On resale, the taxes are normally split 50/50 between the buyer and seller.In the case of leasehold, the lease registration fee is 1.1% only.

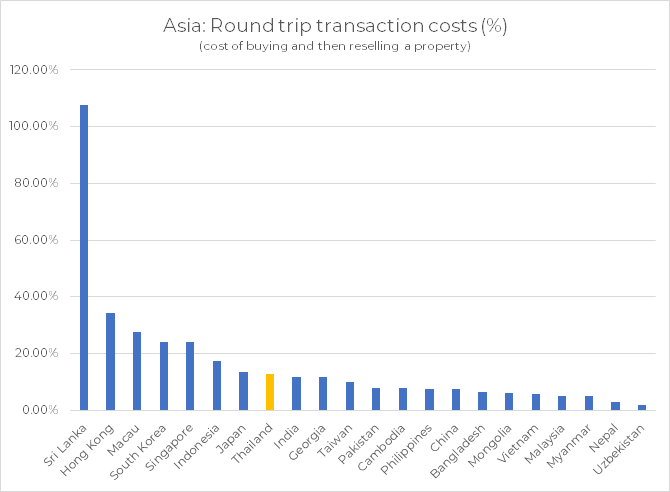

The above amounts to the cost of buying and reselling a property way below other prime markets in Asia

Based on Global Property Guide data

Recurring taxes

In 2019 Thai government introduced a new Land and Building tax. For residential properties, it has a ceiling rate of 0.3%, however, current - as of 2022 - rates top at 0.1% for the highest price bracket.

Real estate investment properties in Thailand

If you’re ready to learn more about luxury houses in Thailand or Phuket villas for investment, look no further than Sunway Estates. Speak to our experts for an insider view of the Thai luxury real estate market and all the information and guidance required.