Investment case study: buying branded residences with developer financing

We are back with another installment in our series of investment cases analysis pieces. You can read the first article here.

For our new readers, in this series we are showcasing the actual practical processes, costs and fees, real life ROIs and other details involved into property purchase in Thailand, as well as our own approach to handpicking the best available property for each client.

👉 SUNWAY says:

If you are looking for a more general information first, you can check out our our library of articles.

Let’s skip right onward to today’s case. A client - let’s designate them Mr. A - wanted to buy a high-end condo or villa for investment on Phuket or Samui. His main focus were assured capital appreciation and liquidity - property must retain and gain value, and be easy to resell for profit at due time. The property also must generate a sustainable rental income in the meantime. Being a seasoned and sophisticated investor Mr. A had a very good idea of what he’s looking for and mainly needed local knowledge and advice on which destinations and projects would match his philosophy the best.

So to sum up, we’re looking for:

- A property with good capital appreciation and liquidity - something that will be in high demand on a resale market.

- A reputable developer to minimize risks.

- Professional rental management - however the client doesn’t want be locked in into the project’s own rental service and wants an option to use 3rd parties to rent out the property if needed.

- This one actually wasn’t in the initial requirements, but was welcome by the client when offered: while Mr. A is aware that in Thailand property financing is generally not available (with some exceptions, depending on location, property type and specific development - contact us to learn more), like any savvy investor, he is interested in optimizing the payment schedule and his cash flow.

Having considered all the above, we start narrowing the options down step-by-step.

Location (.., location, location)

Here is a testament to working together with the client and respecting their expertise. Being an experienced investor, Mr. A from the beginning emphasized that for him to qualify as a good investment, the property must have an exceptional location. Exceptional not just as in ‘very good’, but in its very specific original sense that the location must be unique and attractive in itself, before we even bring the project’s specifics in the picture.

To this end, we offered some beachfront properties, seaview properties, some options next to popular commercial and dining districts and some properties in established integrated master-plan developments. In other words - locations that are by definition scarce and cannot be easily replicated.

Ultimately, while we viewed multiple projects, the location Mr. A liked the most was Laguna Phuket. It’s a unique integrated resort that occupies the entire center of Bang Tao beach. It is developed, owned and operated by Banyan Tree Group. The development started in 1984, and now includes seven hotels, over 20 residential developments, a golf course, restaurants, a spa, retail galleries, and more. It’s a secure, high-end neighborhood with hotel-standard maintenance of common grounds, developed infrastructure, and high connectivity. As the entire Bang Tao area historically developed around Laguna, all the main shopping and entertainment areas are within walking distance or a short drive.

An excellent choice, we might add.

Project

There are actually multiple projects in pipeline in Laguna right now (Banyan Tree continues expanding and developing the area), so the next stop would be narrowing it down to a specific development. In order to qualify for Mr. A’s requirements (high liquidity, reliable appreciation, sustainable rental income) the project must meet the following criteria.

- Low-density development with a relatively low number of units.

- No mandatory rental program (this actually proved to be a big cut-off factor as some of Banyan Tree projects are pure hotel developments, where units has stay under hotel’s management - which isn’t a bad thing in itself, but goes against the requirements in this case)

- Ideally branded residences for added international brand recognition, as well as for additional services and bonuses that increase property’s appeal

- Considering that Laguna isn’t a singular place, but rather sort of a city-in-a-city spanning 1000+ acres, we have to further revisit the exceptional location factor. This time we are looking at location within Laguna, as well as views and distances to the beach and local amenities.

Ultimately one project ticked off all the boxes - Angsana Ocean View.

It’s a luxury, low-rise, low-density (3-5 units per floor) project under Angsana brand (it is also directly connected to Angsana Laguna Resort). It’s separated from the beach by a beautiful lagoon - which means that not only all units have gorgeous lagoon and sea views, but nothing will be developed in front of the project to block those views. All units come with private swimming pools.

The project offers hotel branding (Angsana is one of Banyan Tree’s 5-star hotel brands), but at the same time doesn’t lock the owners into a mandatory rental program (Banyan Tree offers rental management via their internal rental service, but it’s fully optional - owners are free to choose 3rd party rental agency or manage the unit themselves).

Very fortunately at that time the developer was just opening up a new building for sale. So, living up to our reputation as masters of off-market deals and early accesses, we helped Mr. A to get the first pick.

Unit

This will be a fairly short section - there is very few units in the project and we don’t want to give away too much details in order to preserve our clients’ privacy.

That said, it wasn’t an overly complex choice, since, frankly speaking, most units in Angsana Ocean View are good. Because of the project’s unique position, even lower floors have a great lake views, and we’ve been offering the central building, which is directly facing the sea. Mr. A ultimately decided to go for a spacious 2-bedroom on a higher floor to stay above the water and enjoy a more open panorama of the ocean.

Financing

So, this wasn’t a part of the initial inquiry, but came as a nice added bonus for the cash flow. As you might know financing for foreigners in Thailand is not readily accessible. There are notable exceptions - you can learn about them in our respective article - but generally for most buyers and properties it won’t be available. However, Banyan Tree just so happens to be a rare case of a developer that does offer developer financing for all their properties in Thailand (please note that this doesn’t include 3rd-party projects with Banyan Tree branding, like Banyan Tree Riverside Residences in Bangkok).

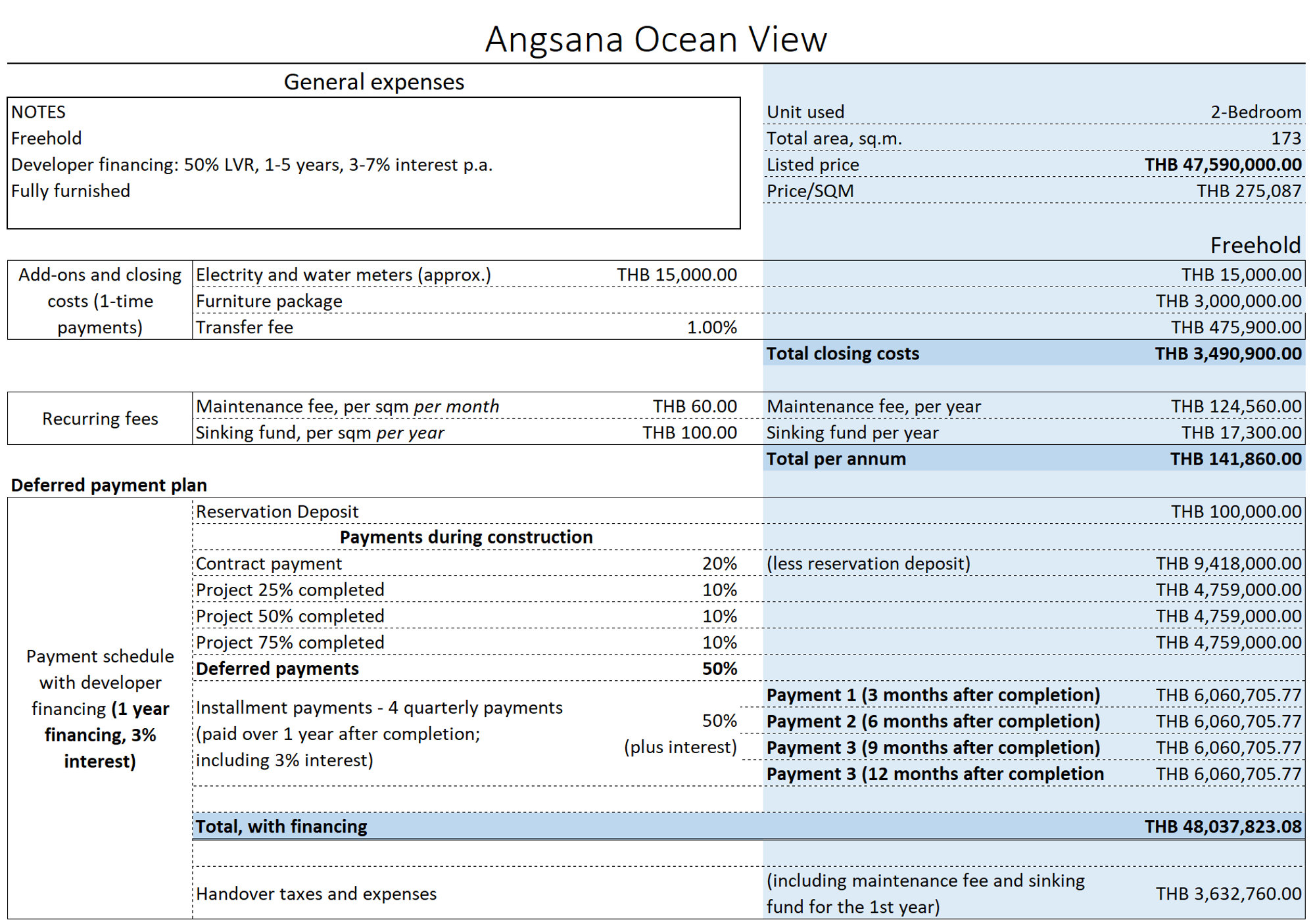

The financing is offered on a simple opt-in basis, with 50% LVR and 3 different plans (the conditions are indicated as of time of writing in 2023):

- 1 year financing with 3% interest

- 3 years financing, 5% interest

- 5 years financing, 7% interest

The above means that you can move into your unit once it’s completed and the first 50% of the price had been paid, and can then repay the remaining half (plus interest) for up to 5 years, while living in the unit or renting it out. This alone moves the property’s investment appeal up a couple notches.

Expenses and payment schedule

The bulk of additional costs is made up by the furniture package cost. The project’s furniture and decorations are made to mirror the Angsana hotel interior design, so it makes sense to go for it (but you are free to buy your own furniture if you prefer).

As for taxes: when purchasing a freehold condo in Thailand, there are withholding tax, transfer fees, and special business tax to be paid (you can read more in our respective article). The total amount comes to around 6.3%. In most cases, the developer pays the most part of taxes, leaving the client to pay only 1%. That’s the case here as well.

Notable difference in fee structure for Banyan Tree projects is that instead of a one-time lump sinking fund payment, they charge a small recurring sinking fund (which makes sense - sinking fund is intended for capital repairs and it tends to deplete over time anyway). However, Banyan Tree has an advantage of scale when it comes to project upkeep - maintenance of the entire Laguna including hotels, residential, F&B, retail venues, common roads etc is centralized, which allows to keep the costs down. This means that you are getting some of the best, most well-kept environments on the island, but the maintenance cost is lower than competitors even after you add in the recurring sinking fund.

As with other off-plan projects, you don’t need to pay out the price right away - and in this case you also get developer financing (discussed in more details above). So not only you get an interest-free installment plan for the duration of construction for first half of the price - you also get financing for the 2nd half for up to 5 years (Mr. A chose 1 year).

Conclusion

Another day - another satisfied client. We are confident that the project will be completed to high standard, will rent well and, if and when Mr. A chooses to resell the unit, they’ll be able to do so fast and with good profit.

P.S. By the way - while Angsana Ocean View is certainly a singular development, Banyan Tree has a wide range of projects - from 140k USD condos to 5.8M USD Oceanfront villas. Developer financing is available for all of them. Contact us if you are interested to learn more.